The Supreme Court of the United States will answer this question in its upcoming term.

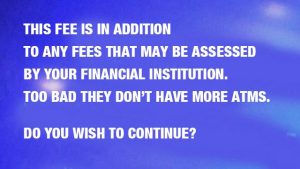

ATM fees are as ubiquitous as the machines themselves. Unless you go to your own bank, you’re going to pay a fee. The fees vary by location. At an ATM in a convenience store that is close to many other stores and ATMs, you’ll pay a little. At an amusement park, casino, or strip club—places with clientele who are captive, captive and desperate, and desperate, respectively—you’ll pay a lot more. However, the rate different customers pay at the same ATM will almost always be the same—whether your ATM card is a Visa or MasterCard or a Diner’s Club Card or a Texaco Gasoline Card or a Walden Books Card or Black AMEX.

The reason, according to a lawsuit that has worked its way up to the nation’s high court, is that Visa and MasterCard—proprietors of the two cards that account for a majority of U.S. ATM withdrawals—are fixing their prices. The U.S. Circuit Court for the District of Columbia Circuit held earlier this year that the plaintiffs in an ATM fee-fixing lawsuit had made a showing of an agreement to fix prices that was robust enough to at least survive a motion to dismiss. This decision differed from the stances of the Third, Fourth, and Ninth Circuits. Enter: The Supremes, who will decide which circuit is correct.

Florida Injury Lawyer Blawg

Florida Injury Lawyer Blawg